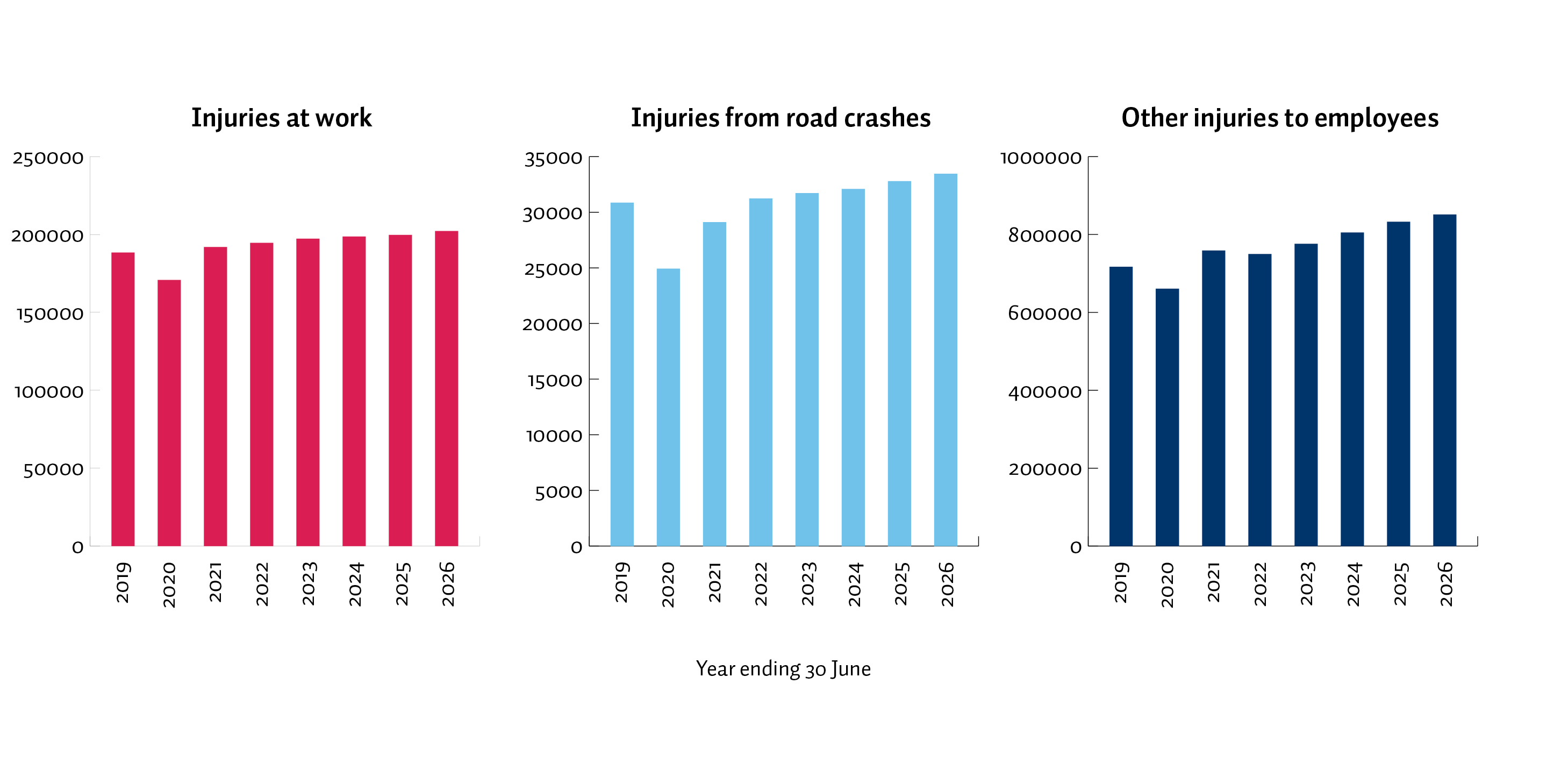

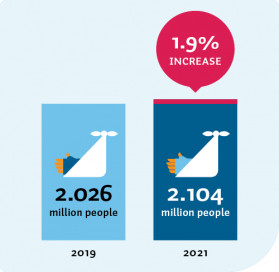

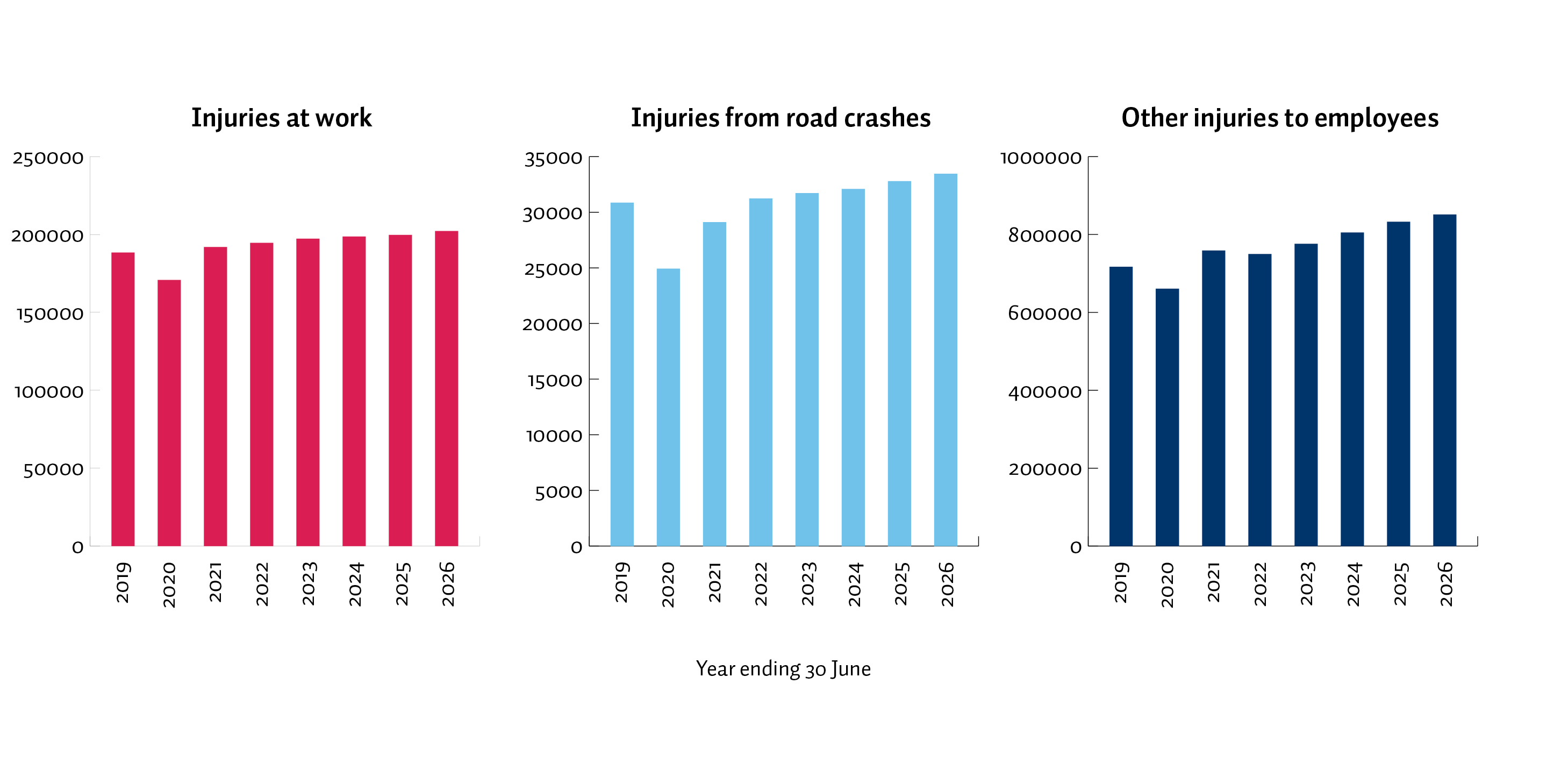

Number of injuries are increasing each year

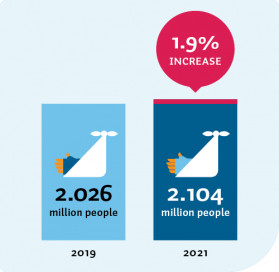

Although the COVID-19 lockdowns in 2020 reduced injuries at the time, we’ve seen a return to the usual number of injuries since then. In the three years since our last consultation on levies, the number of injured people needing support from ACC has grown from 2.026m in 2019 to 2.104m in 2021 (an increase of 1.9% per annum).

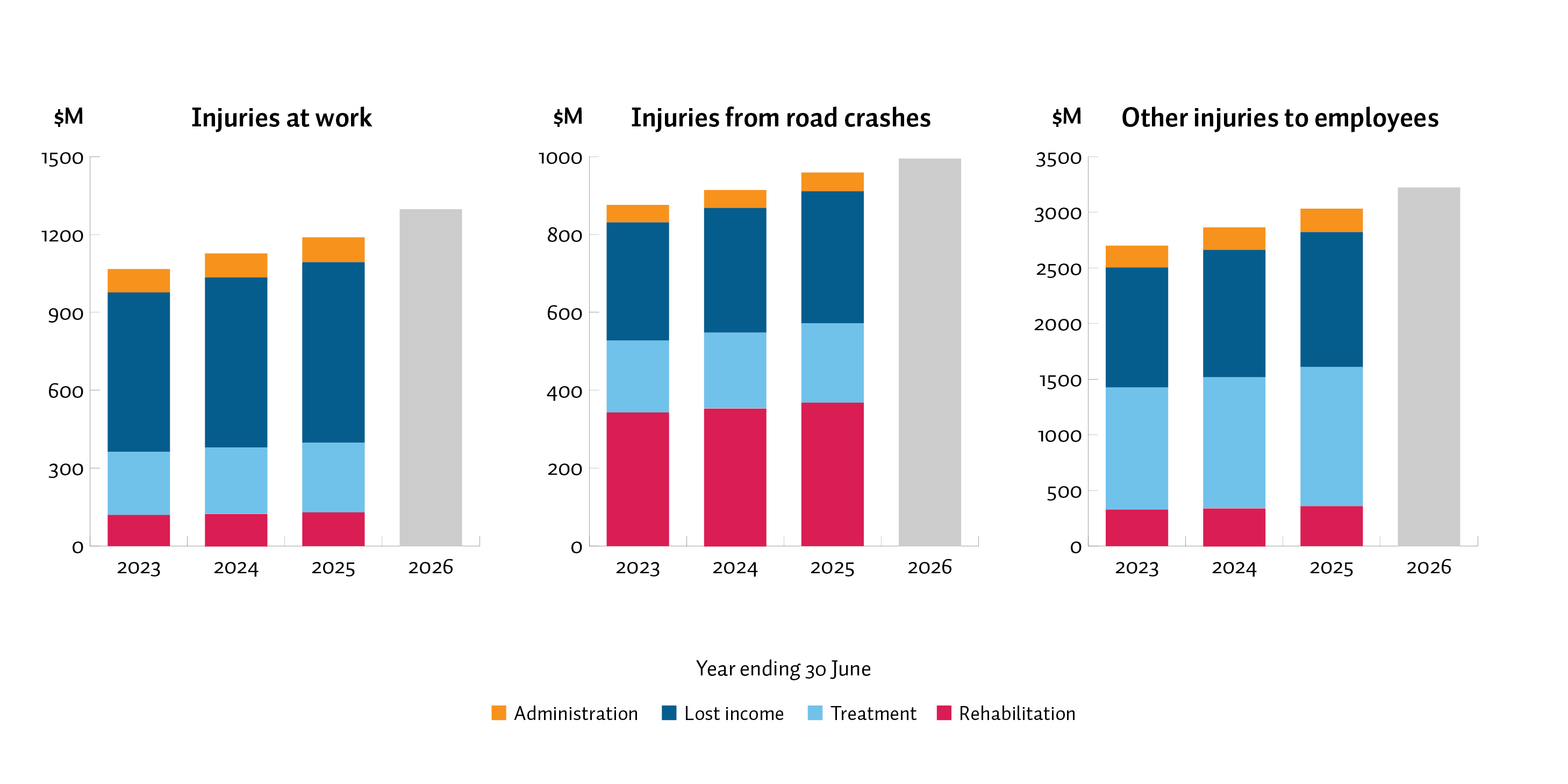

Forecast increase in injuries in the Work, Earners' and Motor Vehicle Accounts

To help keep levies as low as possible, we work with businesses and communities to reduce the number of people injured each year.

Minimising injuries each year has many benefits, not only to the injured person, but also to:

- the person’s whānau who may have to care for them

- their employer who suddenly loses the skills of an employee

- the wider community, such as a sports club or a charity, which can also be impacted when a member or colleague is injured.

There can only be a meaningful drop in injuries and their costs when all of us are playing our part.

Investing in injury prevention

We’re investing in new ways of thinking about injury prevention such as our Preventable campaign which asks us all to take a moment to think about the consequences of doing something before acting.

In 2019/20, we invested $100 million in injury prevention programmes and we’re achieving a reduction in injury costs of $1.80 for every $1 we spend.

You can see examples of our injury prevention work on our website. These efforts are seeing results. However, the overall volume and costs of injuries are still increasing.

Examples of our injury prevention work

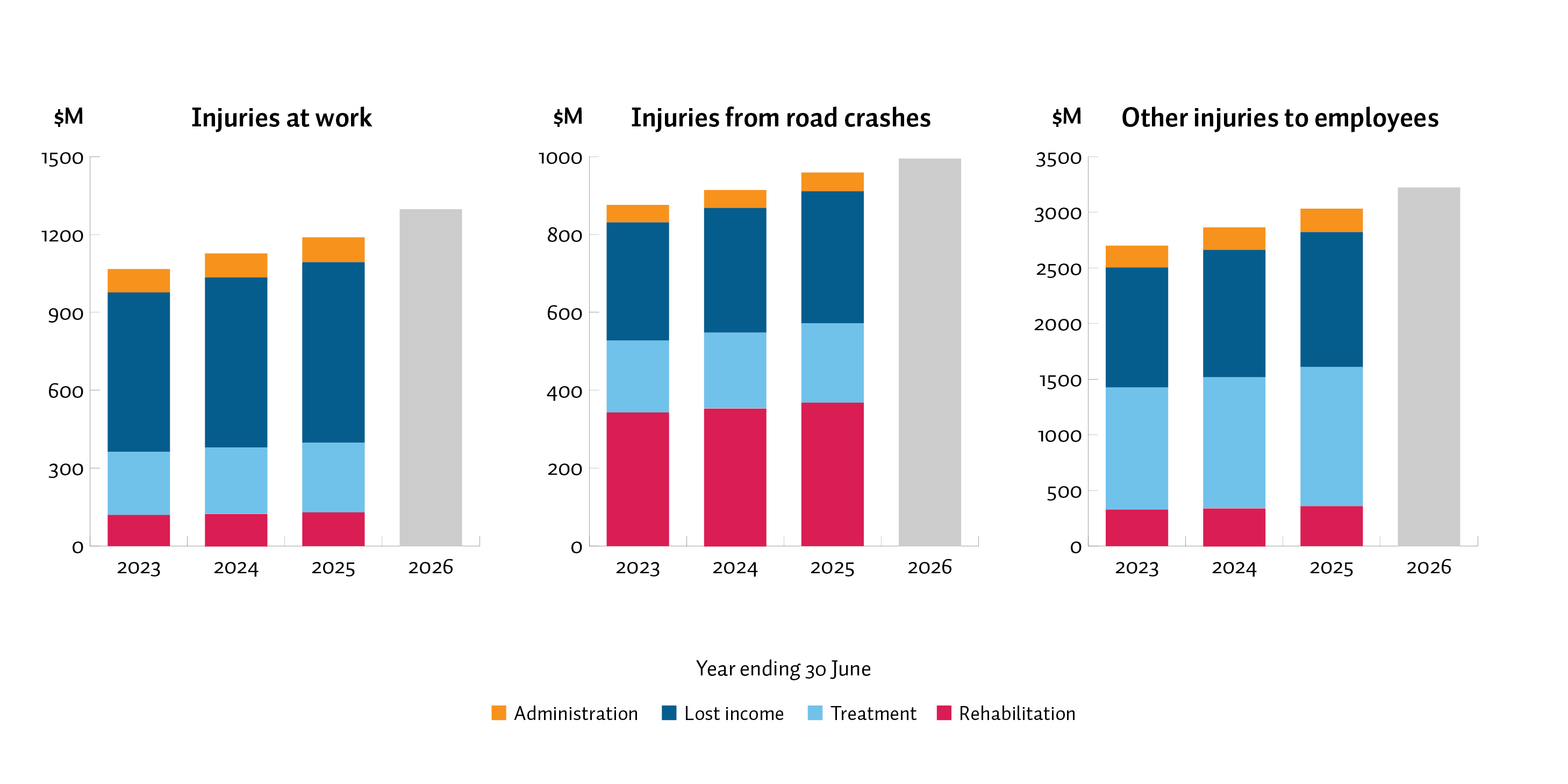

Increasing costs to support injuries

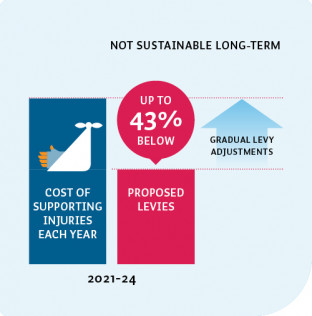

The increasing number of injuries combined with anticipated price increases has resulted in the expected costs to support injured people, over the next three years, increasing by between 4-6% per annum.

This year we’re expecting $4.63 billion will be needed from levies to support the lifetime costs of injuries that are estimated to happen in 2021/22. By 2024/25, this is estimated to increase to $5.2 billion.

Expected New Year Claims Costs

Cost of supporting new injuries (New Year Claims Cost)

| Costs to support |

2022-23 |

2023-24 |

2024-25 |

| Injuries at work |

$1,115m |

$1,168m |

$1,224m |

| Injuries from road crashes |

$872m |

$905m |

$946m |

| Other injuries to workers |

$2,734m |

$2,884m |

$3,043m |

| Total |

$4,721m |

$4,957m |

$5,213m |

Improving the Scheme

We’re always seeking ways to be more efficient in how we deliver better health outcomes for our clients while managing our costs.

Over the past three years, ACC has invested in an online option – MyACC – for clients with less complex needs to manage their recovery. This can provide them with faster access to services and help support a quicker recovery.

To support people to get well sooner, we’ve also:

- modernised how we support the co-ordination of services around injured people and their families

- continued to work with providers of health care services to make it easier for them to work with us and to support their client’s recovery.

After all these benefits have been taken into account, we still forecast that the total number and costs of injuries will continue to increase.