Good health and safety performance leads to safer workplaces

The Accredited Employers Programme (AEP) is best suited to large employers who:

- pay ACC levies of more than $250,000 per year

- are able to manage claims and pay for the costs of treatment and rehabilitation for their employees’ work-related injuries (i.e. act on behalf of ACC).

Accredited employers can qualify for reductions of up to 90% in their Work levies. They can choose to join one of two plans:

- the Partnership Discount Plan

- the Full Self-Cover Plan.

Work to enhance the AEP

As we implement changes to the programme that we co-designed with employers and unions, our current focus is improving how we collect data from Accredited Employers and how we then use this data to identify opportunities for further improvement.

The next phase requires revising the AEP framework before we can implement any of the proposed policy changes to give effect to these improvements. We will continue to work directly with accredited employers, third party administrators, and with workers and their representatives on these changes.

The 2021 levy consultation does not include any of the proposed policy changes from the co-design work undertaken over the past few years.

Our proposed changes for the 2022-25 levy period

As a result of the proposed changes to the Work levy for businesses, we propose the following updates to fees and discounts to the AEP for the 2022/23–2024/25 levy period:

Proposals for the Work levy rates for businesses

| Proposed change | Plans impacted | Impact on levy paid |

|---|---|---|

| Decrease the administration fee from 2.5% to 2.2% of the Work levy | PDP and FSC | Decrease |

| Decrease the unallocated primary health care cost fee from 1.4% to 1.3% of the Work levy | PDP and FSC | Decrease |

| Increase the bulk-funded public health care cost fee from 3.8% to 4.5% of the Work levy | FSC only | Increase |

| Decrease the average discount in the PDP one-year claim management option from 53.0% to 50.0% of the Work levy | PDP only | Increase |

| Decrease the average discount in the PDP two-year claim management option from 60.6% to 57.8% of the Work levy | PDP only | Increase |

What’s driving the need for change?

When we review levy rates, we always assess the implications for the AEP. This includes a review of the cost to treat and care for those who have claims for injuries and the administration costs of supporting the programme.

These changes have often been small in the past but with the time between levy reviews extending to three years, it’s possible that larger movements in fees and discounts could occur.

What’s the impact of the proposed changes?

Proposed decrease to administration fee

We propose to decrease the administration fee to 2.2% for 1 April 2022.

| 2019/21 Levy ($000's) |

2022/25 Consultation ($000's) |

|

|---|---|---|

| Administration expenses | 4,793 | 4,850 |

| Standard levy | 189,000 | 219,500 |

| Administration fee | 2.5% | 2.2% |

Proposed increase to unallocated primary healthcare cost fee

From 1 April 2022, we propose decreasing this fee from 1.4% to 1.3% of the Work levy for accredited employers. A decrease in work claims that cannot be attributed to individual employers has led us to make this proposal.

Why is there an unallocated primary healthcare cost?

Some of the workplace injury costs we pay are short-term medical costs that can’t be attributed to individual employers. This is because some workers don’t or can’t provide employer-specific information when they seek treatment or other support for work-related injuries.

Although these claims are rare, we still need to collect money to cover these costs. We do this through the unallocated primary health care cost fee, which is included in accredited employers’ total Work levies.

Proposed decrease to bulk-funded public healthcare cost (BHC) fee

From 1 April 2022, we propose to increase the BHC fee from 3.8% to 4.5% of the Work levy for accredited employers. BHCs are expected to increase from an average $40 million a year in 2019/20–2021/22 to $48 million a year in 2022-25. This is consistent with an overall increase in the expected cost of bulk-funded health care. The pool of liable earnings to pay for these BHCs is also increasing but not as much as the BHCs, which increases the amount required to cover these costs.

Below you’ll see our calculations for the proposed BHC fee:

What is BHC?

The BHC fee is a payment we make to district health boards (DHBs) to cover acute treatment for accident-related injuries. We pay this as a bulk amount based on the expected cost of the services the DHBs will provide as part of ACC cover. A portion of levy funding in ACC’s Accounts is used to cover the BHC fee. Accredited employers are charged this amount as a percentage of their Work levies.

Proposed changes to stop loss limits

The maximum stop loss limit is currently 250%, and the minimum 160%, of an employer’s expected claims costs. We calculate these expected costs using the employer’s standard Work levy before any discounts are applied. We review the limits (which we set as a percentage of the Work levy) every year so they reflect changes in the Work levy.

The table below shows the calculated maximum and minimum stop loss limits as percentages of the Work levy. The proposed decrease to the Work levy means the percentages increase.

| Partnership Discount Plan 1 year (PDP1) |

Partnership Discount Plan 2 years (PDP2) | Full Self-Cover Plan | ||||

|---|---|---|---|---|---|---|

| 2019/20- 2021/22 | 2022/23- 2024/25 | 2019/20- 2021/22 | 2022/23- 2024/25 | 2019/20- 2021/22 | 2022/23- 2024/25 | |

| 160% of expected claims costs | 73.60% | 82.70% | 86.40% | 97.10% | 140.00% | 163.20% |

| 250% of expected claims costs | 115.00% | 129.20% | 135.00% | 151.70% | 218.80% | 255.00% |

What is stop loss cover?

Stop loss cover protects accredited employers against unexpectedly high total injury costs during a cover period (e.g. if there are a high number of work-related accidents within a very short timeframe).

Stop loss cover is compulsory for employers in the FSC and optional for those in the PDP.

Accredited employers select a stop loss limit from a range of expected claims. They pay all claim costs up to the nominated amounts, with ACC covering any additional costs.

The levy for stop loss cover is based on the expected variability in claims history.

Proposed discount changes to the PDP

The total levies employers in the PDP pay depends on their relevant industry classification unit and whether they choose the one or two-year plan. Currently the average levy discounts are:

- 53.0% of the Work levy for the one-year plan

- 60.6% of the Work levy for the two-year plan.

We propose, from 1 April 2022, to decrease the average levy discounts for the PDP to:

- 50.0% of the Work levy for the one-year plan

- 57.8% of the Work levy for the two-year plan.

This decrease is caused by changes in claims payment patterns. We expect a smaller proportion of claims payments to fall within the claims management period compared to 2018. Therefore, employers should receive a lower discount on the Work levy.

As the severity of accidents varies by industry, PDP discounts depend on each employer’s levy risk group e.g. an industry with a high percentage of low-cost claims will receive a larger discount because it will have contributed a higher proportion of payments during its claims management period.

In the table below, you’ll see how we calculated our proposed discount changes.

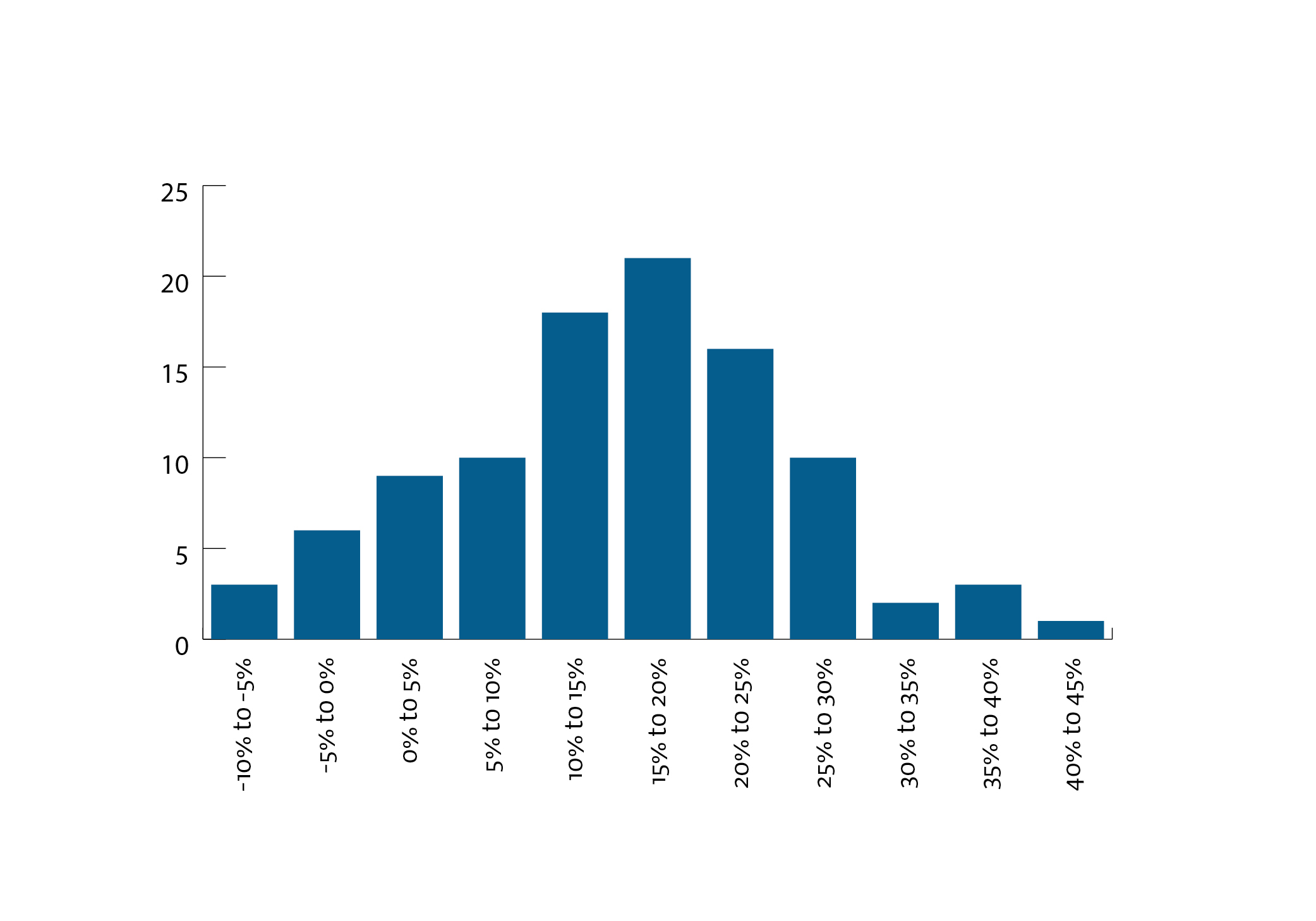

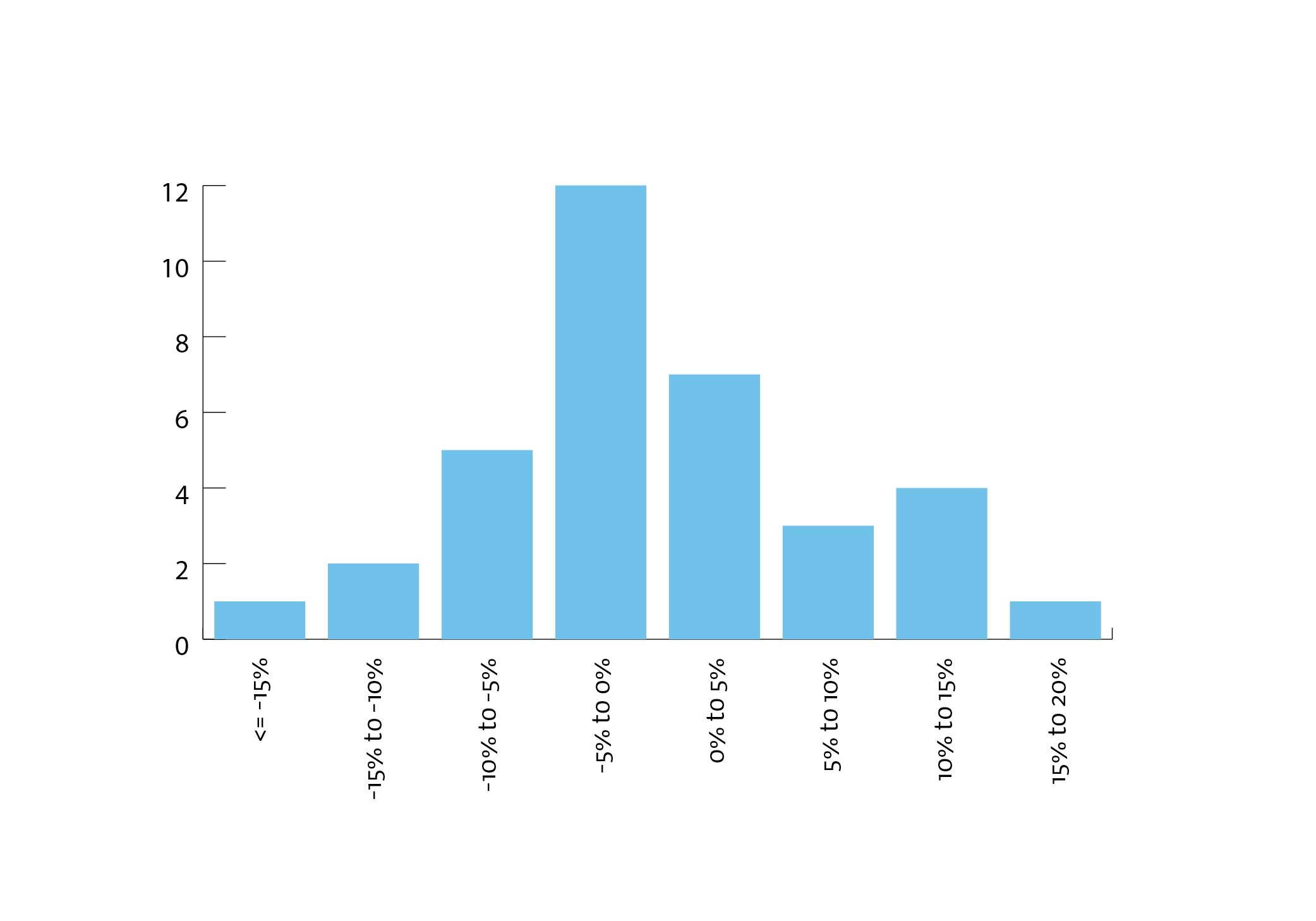

Changes in estimated levy rates between consultations for accredited employers in the Full Self-Cover Plan

Changes in estimated levy rates between consultations for accredited employers in the Full Self-Cover Plan