The Work Account

| We propose decreasing the average Work levy rate for employers and self-employed from $0.67 to $0.63 per $100 of payroll for 2022/23, increasing this to $0.65 in 2023/24, and $0.67 in 2024/25. |

|---|

The levy collected for the Work Account is used to support injuries to workers that occur at work. Over the past five years, there’s been good progress made in reducing the risks of a fatal injury at work. However, the overall risk of injury while working is increasing over time.

Work-related injury targets at a glance, StatsNZ

The proposed changes and background information are outlined below. For a more in-depth look at how we arrived at the recommended levy rates, see our detailed pricing report for the Work Account or information packs for each Levy Risk Group.

Workplace injury prevention

In response to this, we’ve increased our investment in workplace injury prevention by $12m per annum since 2017. An example of our new injury prevention investment includes the workplace injury prevention grants which provide $22 million over five years to help business groups:

- establish harm reduction programmes targeting their sectors

- grow innovation across the health and safety system.

Workplace Injury Prevention Grants

We’re also supporting WorkSafe NZ to expand their ability to develop and deliver additional education programmes by providing up to $15m per annum in additional injury prevention funding.

Increasing injury costs

The cost of injuries is expected to rise due to an increase in the:

- numbers of injuries requiring time off work

- length of the recovery period required before the worker can return to work.

For the Work Account, these cost pressures have been offset by the impact of economic changes on the Account and the lower funding position target introduced in 2019. The result is the proposed average levy reducing in 2022/23 and then slowly increasing.

Setting levies for individual businesses

Businesses pay different levy rates depending on how risky their primary business activity is (i.e. what the risk of injury is in relation to the type of work employees are doing).

After assessing this risk, ACC allocates all businesses into one of 539 ‘classification units’ (CU). These CUs are grouped into one of 142 ‘levy risk groups’ (LRG) based on their injury risk profiles (i.e. the frequency and severity of injuries, as well as how long it takes for injured workers to return to work - represented by the estimated total cost of claims, compared to wages paid).

ACC sets the levy rates for businesses at the LRG level.

Sole trader

What you are currently paying:Industry: {{ userInput.bic.text }}

Structure: Sole trader

Projected income: {{ userInput.structure.soleTrader.amountParsed | dollarize }}

Your projected income may be impacted by the full time minimum, or a threshold known as the Liable Earnings maximum. Read our liable earnings proposal for more information.

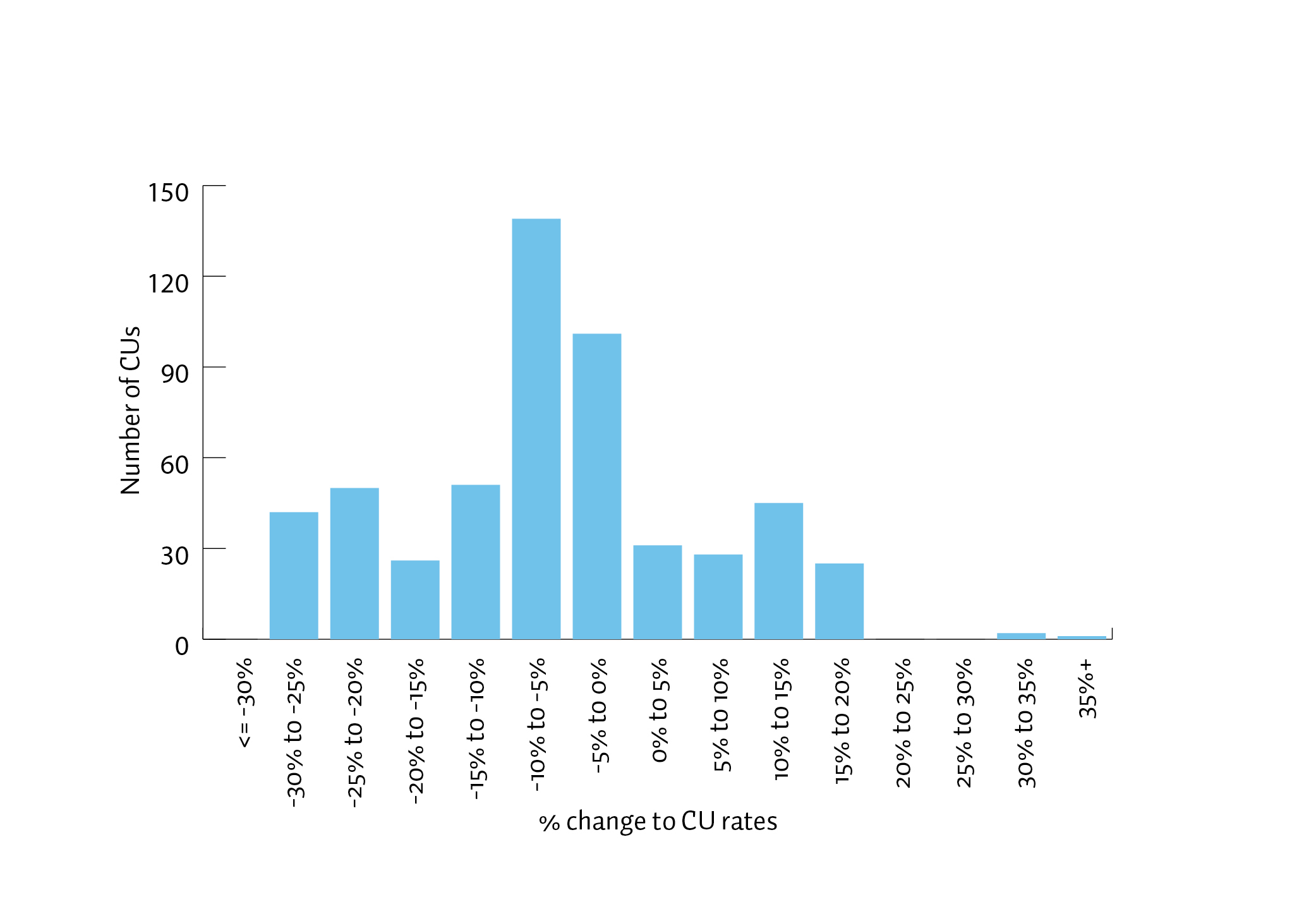

While we’re recommending that the average Work levy is decreased next year with small increases in the following two years, levy rates for each CU are also updated to reflect any changes in their claims patterns. This means levy rates for some businesses will increase when the average rate is decreasing or decrease when the average rate is increasing.

These results are estimates based on the proposed levy rates and will be subject to Cabinet's final decisions and any changes in your liable earnings each year.

The Minister for ACC is also consulting on changes to specific CUs for: retail and wholesale trade businesses; professional and community cricket; and prime contractors, which are not reflected in these estimates. You can find out more about these proposals here.

Shareholder

What you are currently paying:Industry: {{ userInput.bic.text }}

Structure: Shareholder employee

Projected income: {{ userInput.structure.shareholderEmployee.totalAmountNotCapped | dollarize }}

While we’re recommending that the average Work levy is decreased next year with small increases in the following two years, levy rates for each CU are also updated to reflect any changes in their claims patterns. This means levy rates for some businesses will increase when the average rate is decreasing or decrease when the average rate is increasing.

These results are estimates based on the proposed levy rates and will be subject to Cabinet's final decisions and any changes in your liable earnings each year.

The Minister for ACC is also consulting on changes to specific CUs for: retail and wholesale trade businesses; professional and community cricket; and prime contractors, which are not reflected in these estimates. You can find out more about these proposals here.

Employer

What you are currently paying:Industry: {{ userInput.bic.text }}

Structure: Employer

Projected income: {{ userInput.structure.employer.amountParsed | dollarize }}

While we’re recommending that the average Work levy is decreased next year with small increases in the following two years, levy rates for each CU are also updated to reflect any changes in their claims patterns. This means levy rates for some businesses will increase when the average rate is decreasing or decrease when the average rate is increasing.

These results are estimates based on the proposed levy rates and will be subject to Cabinet's final decisions and any changes in your liable earnings each year.

The Minister for ACC is also consulting on changes to specific CUs for: retail and wholesale trade businesses; professional and community cricket; and prime contractors, which are not reflected in these estimates. You can find out more about these proposals here.

Our recommended levy rates

The Minister for ACC is also consulting on changes to specific CUs.

Working Safer Levy

We also collect a levy on behalf of the Ministry of Business, Innovation and Employment (MBIE) for supporting WorkSafe’s enforcement, education and engagement activities across the country.

This is currently a flat rate of $0.08 per $100 of liable earnings and is not part of this consultation.

ACC levy products for business

We’re always making small adjustments to levy products, and looking for opportunities to improve these, to ensure they keep up with changes in workplaces.